The personal finance regrets of a 40-something

“Some People Are So Poor, All They Have Is Money”

Dear Friends,

By the time we’re in our forties, we’ve made enough personal finance decisions to know that some were lucky, some were unlucky, and that our financial situation today could have been entirely different. I try not to think about the stocks that I sold too early (Tesla, Apple) or too late (Moderna). I try not to think about the more than $350,000 that we have handed over to our landlords in rent over the past eight years and what would have happened if we had instead put that money into a down payment on a Bay Area home whose value has nearly doubled in the same amount of time. (The answer: we’d be roughly $800,000 wealthier.)

Ideally, we accumulate enough financial experience by our forties so that we make better financial decisions during the second half of life. But that’s not how luck works. Tesla’s stock could have tanked shortly after I sold it back in 2014. (Instead, it went from about $15 per share to over $400 per share at its peak.) Then again, for anyone who did buy Tesla stock back in September, it has since lost nearly two-thirds of its value since.

With each little decision over time, we construct our own economic history. And when we add up all of our individual economic histories, we have the story of the global economy.

So gloomy, so good

Just about every month since 1992, Gallup has called roughly 1,000 Americans and asked them the following two questions:

How would you rate economic conditions in this country today -- as excellent, good, only fair, or poor?

Right now, do you think that economic conditions in the country as a whole are getting better or getting worse?

As you can see in the chart below, Americans are pessimistic about the state of the economy. I’m not surprised. The media have relentlessly put up pessimistic headlines: prices are up, stocks are down, job growth is slowing, Google, Microsoft, and Amazon are laying off employees.

But there is another story about the economy that hasn’t gotten as much attention:

Inequality is decreasing

Real wages are way up over the past decade

Social mobility is increasing

There are still far more job openings than people looking for work

We are perhaps in the midst of a transformation of the economy that makes it work for more people. But to appreciate the changes underway, we need to zoom out from the daily headlines.

Remember 2014? I sure do. It was the year that Iris and I moved from Mexico City to Seattle. I began a new job at the Gates Foundation. We put all of our savings into a down payment to buy a house, leaving us with around $200 in our checking account. Just a couple of weeks later, our two families met for the first time at our courthouse wedding. I knew I was entering a new phase of life — adulting, we called it — and I was terrified by the idea of having to make a mortgage payment for the next 30 years.

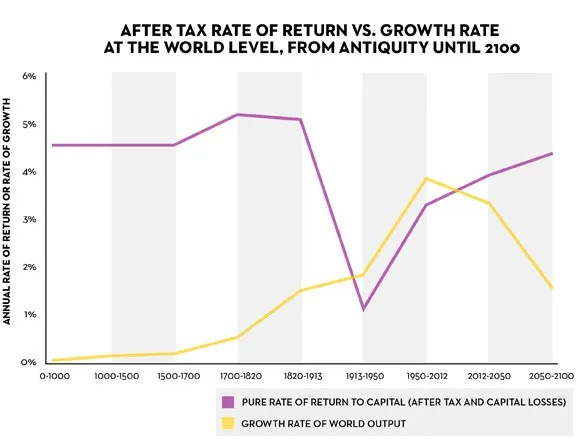

But enough about me. By late 2014, Obama’s approval rating had dropped from 70% when he was elected to 40% (which is lower than Biden’s approval rating today). The recovery from the 2008 economic crisis was slow going. Everyone was talking about a best-selling book by a French economist whose name we couldn’t pronounce: Thomas Piketty’s Capital in the Twenty-First Century. Few of us read all 700 pages, but you couldn’t deny the force of his simple observation, as laid out in the chart below: the return on investments outpaced economic growth overall. And since rich people made their money from their investments, whereas the rest of us make our money from our paycheck, inequality was destined to get even worse.

What you can see in the chart above starting in 1950 is the rise of shared prosperity. Both workers and investors were winning. The global economy was growing and the stock market was growing right along with it. But then starting around 2012, when Obama defeated Romney, the rate of returns of the stock market kept growing while the growth of the global economy began to slow. Picketty extrapolated the trends to predict that the growth rate of the global economy would continue shrinking while investments would continue to grow, thereby worsening inequality for decades to come.

We got it into our heads back in 2014 that economic inequality was bad and destined to get worse. Then Trump was elected and we were too distracted by the crazies to pay attention to what actually happened.

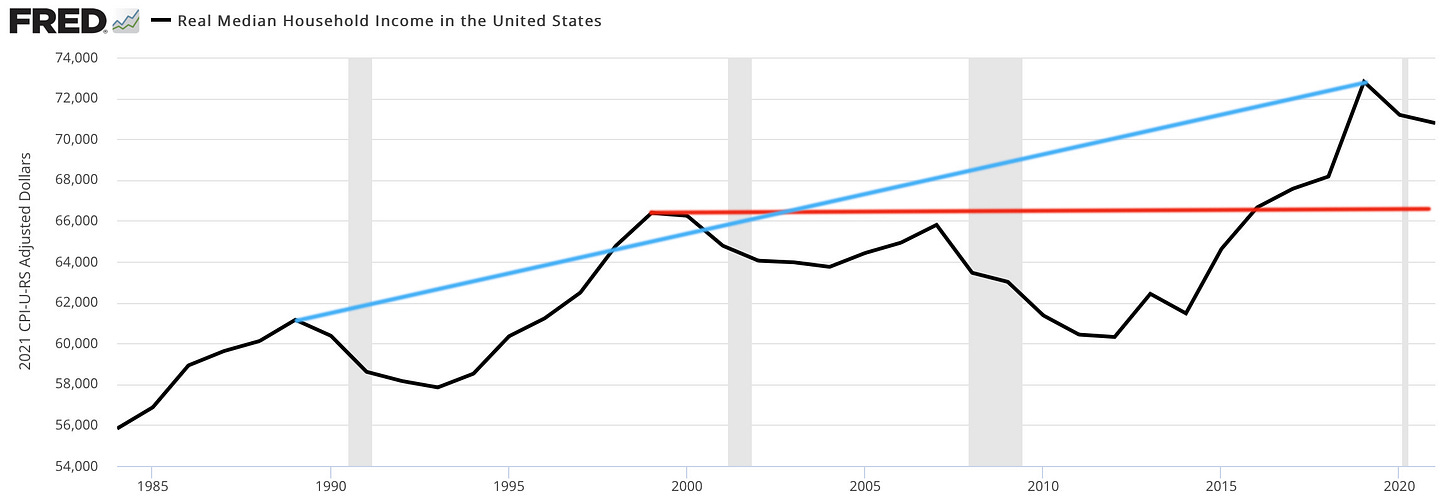

There were two other economic indicators that we couldn’t stop talking about at the time. First, an up-and-coming economist, Raj Chetty, published a landmark study showing that social mobility had stayed flat for decades and that the percentage of children making more money than their parents had fallen consistently from 1940-1984. Second, the media started labeling millennials “the unlucky generation” as real wages fell while housing, healthcare, and college became unaffordable.

We assumed these trends would continue. Real wages would continue to fall, inequality would continue to increase, and social mobility would stay flat. But that’s not what happened. Starting in 2015, real wages began to grow significantly — especially for the poorest. Social mobility has improved considerably. Both income inequality and especially wealth inequality have declined thanks to the growth in wages and the decline of the stock market. 2021 and 2022 saw record job growth and wage growth even as fewer Americans want to work. As I write this, there are still more job openings than Americans looking for a job.

We have understandably been distracted by other events: the rise of Donald Trump and illiberal populism, the pandemic, the attack on the US Capitol, Russia’s invasion of Ukraine, and inflation. Hidden behind so much bad news, the economic trends have been remarkable and there is good reason to believe, as Matt Yglesias describes, that income inequality will continue to fall in the coming years (at least if DeSantis isn’t elected president in 2024).

Now, #BackToMe. In October, I will be laid off. Granted, this was part of the deal when I started working at Hewlett Foundation nearly eight years ago. And just like all of those Google employees laid off last week, I get a pretty sweet severance package, so I’m not complaining. Our plan, as I mentioned a couple of weeks ago, is to move back to Mexico and build a house in Oaxaca. The land will cost roughly $100,000 and the building costs another $100,000.

So this has got us thinking: is now the time to invest in Oaxaca just as the remote worker boom subsides? Or should we use that money as a down payment on a Bay Area fixer-upper now that housing prices have fallen? But what if San Francisco today — “the most empty downtown in America” — becomes the next Detroit, a vestige of an economic engine that then moved to Asia? Wouldn’t that money be better off in the stock market? Doesn’t the stock market always produce stronger returns than housing?

Who knows. Maybe we’re making a brilliant financial decision, maybe a terrible one. Only time will tell. What I have learned during my first half of life is that if you optimize only for your finances, you unwittingly sacrifice other aspects of your life: your creativity, control over your time, your relationships, hobbies, and sleep. And so while I’m not entirely convinced of the financial logic of our decision, I am pretty damn convinced about the happiness logic.

🤘Music to drive fast to in the suburbs

The experts can’t explain it. Why are the youth so sad and anxious? Is it social media? Over-protective parenting? That they no longer seem to have sex or do drugs? Cancel culture and safe spaces gone awry?

I have the answer. These poor kids don’t have rock and roll!

Trust me, I listen to more Nick Drake and Ani DiFranco than anyone else of my demographic on Spotify, but even I know the importance of occasionally rocking out.

As soon as we got our driver’s licenses, my oldest friend Kevin and I used to drive our Honda Accord and Saturn SL1 as fast as we could around the Southern California suburbs.1 There wasn’t much else to do. These were the songs we listened to.

Now that I’m a middle age cyclist, might I suggest that the playlist pairs nicely with the East Bay’s Pinehurst Loop. Press play as you drop down into Redwood Road (a delight that is currently closed to cars) and enjoy some 1990s rock and roll bliss.

🧰 A useful tool

I had been using Pocket to read the web for 15 years. But over the winter break, I switched over to Readwise’s Reader, which integrates with my library of book and PDF highlights, and has GPT-3 built in to summarize those sections of text that could have been more concise.

Let me know how it goes for you if you give it a try.

Have a great week,

David

I got my driver’s license one month before Kevin and felt entirely superior for during those four weeks.